No data available

-

WatsUpTV now on TV

WatsUp TV, A Pan - African Entertainment TV Channel with a packaged entertainment channel for the Pan African Bi- Lingual community. -

Request Your favorite Music Videos

Request Your favorite Music Videos... Follow us on twitter @WatsUpTV #FanTweetRequest

Ads

We are on Facebook

STATS VISIT

-

Online : 25

-

Today : 0965

-

Total : 0664480*Since October 27, 2016

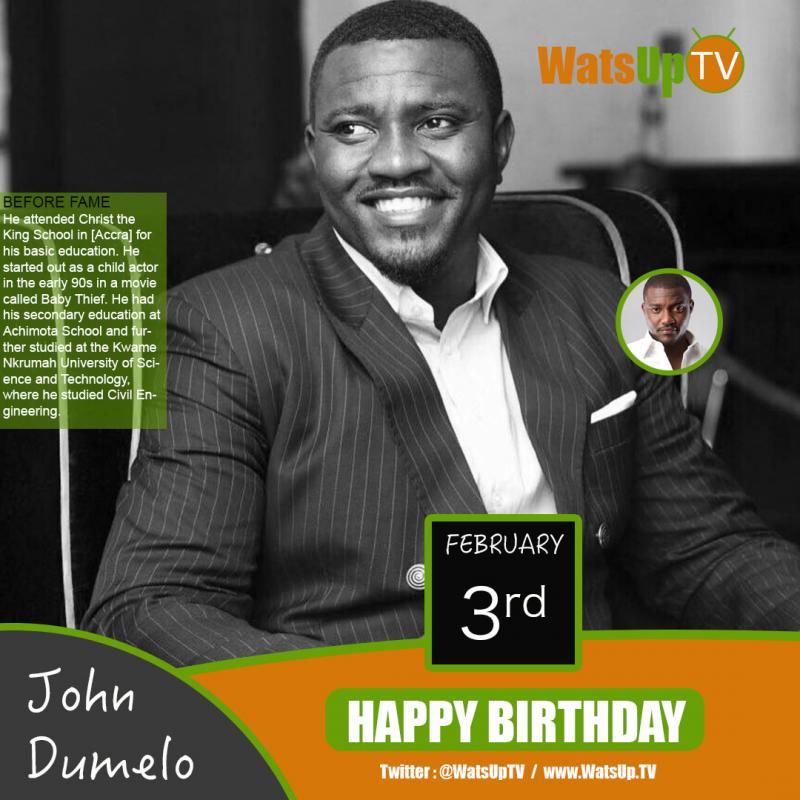

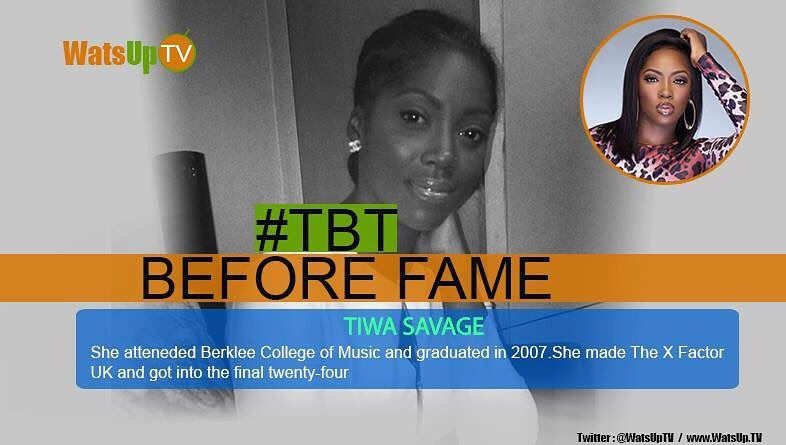

#TBT #BEFOREFAME

-

TIWA SAVAGE

She atteneded Berlee College of Music and graduated in 2007.She made The X Factor UK and got into the final twenty-four